Accepting payments globally is essential for businesses aiming to expand their reach beyond borders. Stripe, a leading payment processing platform, makes it easier for businesses to accept international payments while offering flexibility and security. In this article, we will explore how to set up Stripe for global payments, compare it to other payment processors like PayPal, and how to integrate it with ePay payment systems.

Why Choose Stripe for Global Payments?

Stripe is a powerful payment gateway that allows businesses to accept payments globally. It supports multiple currencies and payment methods, making it an ideal solution for businesses looking to scale internationally. Whether you are running an online store, offering services, or managing a subscription-based business, Stripe provides a seamless integration that makes receiving payments from different countries hassle-free.

Here’s why Stripe stands out for global payment processing:

- Multiple Currency Support: Stripe allows businesses to accept payments in over 135 currencies. This means your customers can pay in their local currency, and you can receive the funds in your preferred currency.

- Secure Transactions: Stripe employs robust security measures, including end-to-end encryption, to protect sensitive data. This is critical when accepting payments from various parts of the world.

- Easy Integration: Stripe integrates with a variety of e-commerce platforms, CRM systems, and accounting software, making it a versatile tool for businesses of any size.

How to Set Up Stripe for Global Payments

To start accepting payments globally with Stripe, follow these steps:

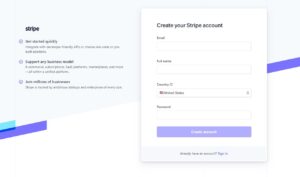

Step 1: Create a Stripe Account

Before you can start processing payments, you need to sign up for a Stripe account. Here’s how:

- Go to Stripe’s official website and click “Sign In” then click on “Create account“

- Provide the necessary details, including your business name, email, and location.

- After signing up, you will need to verify your email and business information.

Step 2: Enable Multiple Currencies

Once your Stripe account is set up, enabling multiple currencies is essential for accepting payments globally.

- Navigate to the Settings section of your Stripe dashboard.

- Under the Payments and Payouts section, enable Multiple Currencies.

- Select the currencies that you want to accept. You can choose to either let Stripe automatically convert the currencies to your default currency or manage the conversion manually.

Step 3: Configure Payment Methods

Stripe supports a wide range of payment methods, including credit cards, debit cards, bank transfers, and popular local payment methods. To ensure that customers globally can use their preferred payment methods, configure these options:

- Go to Payment Methods in the dashboard.

- Enable payment methods like Visa, Mastercard, American Express, and international payment options like Alipay, WeChat Pay, and SEPA Direct Debit.

- Stripe also integrates well with ePay payment systems, allowing businesses to process payments from countries where ePay is commonly used.

Step 4: Set Up Stripe Checkout

Stripe Checkout is a pre-built, hosted payment page that simplifies accepting payments globally. It’s easy to integrate into your website and supports various payment methods.

- Generate a Stripe Checkout button and embed it on your website.

- Customize the payment page to include your branding and preferred payment methods.

- Once everything is set up, you can start accepting payments from customers around the world.

Integrating Stripe with Other Payment Gateways: PayPal and ePay

While Stripe is highly effective for global payments, many businesses choose to use multiple payment gateways for flexibility. Two common options are PayPal and ePay.

Stripe vs. PayPal

Both Stripe and PayPal are leading players in the global payment processing market. Here’s a comparison to help you understand when you might use one over the other:

- Ease of Use: Stripe requires some technical setup, especially for businesses that need customized payment solutions. PayPal, on the other hand, is easier to set up and is widely recognized by consumers worldwide.

- Fees: Both platforms charge transaction fees, but PayPal’s fees are slightly higher for international payments. Stripe’s flat rate of 2.9% + $0.30 for most transactions makes it a cost-effective solution.

- PayPal Account Requirement: PayPal requires users to have a PayPal account to send and receive payments. Stripe allows customers to pay directly with their credit or debit card, without creating an account.

- Customer Trust: PayPal has built a strong brand that customers trust, particularly for peer-to-peer payments. If your business caters to customers who are more familiar with PayPal, offering it alongside Stripe might be a good idea.

Using Stripe with ePay Payment Systems

ePay is widely used in certain regions, such as Eastern Europe and Asia. Integrating Stripe with ePay allows businesses to cover more ground in regions where ePay is a popular payment method.

- Enable ePay Payments: In your Stripe dashboard, go to the Payments section and enable ePay if it’s available in your region.

- Test the Integration: Before going live, ensure that ePay payments work seamlessly by conducting test transactions.

- Monitor Payments: Keep track of ePay payments in your Stripe dashboard and adjust settings as needed.

By using Stripe, PayPal, and ePay together, businesses can offer a comprehensive range of payment options to their global audience, ensuring that customers have the freedom to choose their preferred method.

Benefits of Accepting Payments Globally

Increased Sales Potential

By accepting payments globally, your business can tap into new markets and reach a larger customer base. Whether it’s expanding into Europe, Asia, or Latin America, accepting payments in local currencies increases your chances of closing sales.

Enhanced Customer Experience

Offering multiple payment methods like credit cards, PayPal, and ePay ensures that your customers can pay in the way that suits them best. This enhances the user experience and reduces cart abandonment rates.

Flexibility in Payment Processing

Stripe’s ability to support multiple currencies and payment methods allows businesses to offer flexible payment options. Whether your customers want to pay with a credit card, bank transfer, or PayPal account, Stripe can handle it all seamlessly.

Conclusion: Scale Your Business with Stripe

Stripe makes it easy to accept payments globally, offering a comprehensive solution for businesses of all sizes. By enabling multiple currencies, integrating with payment methods like PayPal and ePay, and setting up Stripe Checkout, your business can start accepting payments from customers worldwide.

Whether you’re a small business or an enterprise, Stripe’s flexibility, security, and global reach can help you scale and grow. Combine it with PayPal and ePay for a well-rounded payment system that meets the needs of your global audience.

Now is the time to take your business global with Stripe and offer customers the convenience they expect from an international brand.